As usual, we will start by reviewing the past week…

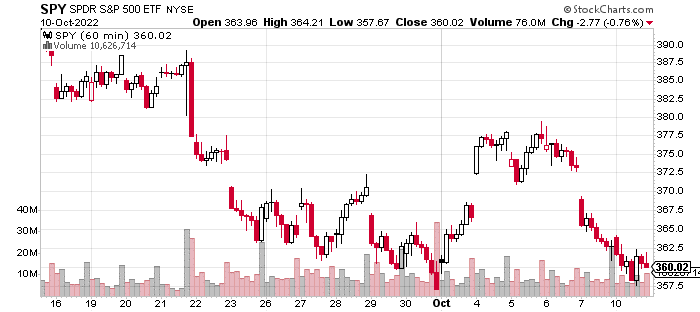

Here is an hourly, 3-week chart of the S&P 500 (SPY):

Over the last week, the S&P 500 is down by about 2%. Yet, this doesn’t really do justice to the volatility.

But, these gains were all given back in the aftermath of the jobs report.

What Was So Bearish About the Jobs Report?

On the surface, there wasn’t anything too concerning. The US economy added 263,000 jobs in September which was just short of expectations of 275,000. Wage growth also came in quite strong but in line with expectations. The unemployment rate dropped to 3.5%.

The good news for the economy is that despite a series of challenges and headwinds like inflation, higher rates, slowing growth, etc. The US economy continues to add jobs. The resilience is notable and from an objective perspective, quite impressive.

But, this is an environment where the ‘financial economy’ and ‘real economy’ are on divergent paths. In some ways an exact inverse of the post-March 2020 period when financial assets were racing higher, even while the economy was dealing with 10%+ unemployment.

In essence, the Fed’s hawkish stance is going to end in one of two ways – either inflation moves lower in a meaningful way or the economy starts to weaken, and the Fed has to back off.

The former scenario seems less likely following last month’s inflation data which actually saw a re-acceleration of monthly core CPI. And, the latter scenario may happen but it’s clearly not imminent.

Therefore, we are dealing with a reality of higher rates and higher rates for longer. Higher short-term rates are a headwind for financial assets because they are a magnet for capital. And, this becomes increasingly attractive during a period of volatility.

If these trends persist, it’s likely that the 2-year will be yielding more than 5% at the end of the year. It wouldn’t be hard to blame investors for putting their money in these securities especially in a year with the S&P 500 (SPY) down more than 25%.

The Fed Call

This brings up a bigger-picture issue. The last decade was one of the best for equity owners due to a combination of low inflation, low rates, and an accommodative Fed. In essence, we had a…

Continue reading at STOCKNEWS.com